In today’s world, teaching personal finance in college is imperative. Money flows freely among this generation, often leading to careless spending. Every student should receive these lessons to empower them in their financial decisions, including budgeting, investing, and money management.

As kids grow into teenagers, they tend to resist parental guidance, influenced by peer pressure. Parents often struggle to teach money matters because teens rarely listen. However, it’s crucial for children to understand their family’s financial situation and the consequences of reckless spending.

Financial Education = Building a Successful Life

As an Indian, many have faced financial difficulties and regretted not saving or investing earlier. Prioritizing financial education in schools helps students become informed consumers, productive employees, and better prepared for retirement. While subjects like Math and Science are important, financial literacy is equally vital. Introducing financial education to middle school students through personalized lessons can have a lasting impact.

The First Step Toward Success

Teaching students about finance is the first step towards their success. It fosters financial awareness and readiness for future challenges.

A Healthy, Happy, and Secure Life

Basic personal financial skills are essential for a healthy, happy, and secure life. Understanding budgeting, saving, debt management, and investing profoundly influences one’s life outcomes.

Example Illustrating the Need for Finance Education:

When a student leaves home for college and faces financial independence for the first time, it’s a significant moment. Initially, they might enjoy the freedom but soon realize the importance of managing money as they struggle to make ends meet. A solid grasp of money management equips them to handle daily financial decisions confidently and independently.

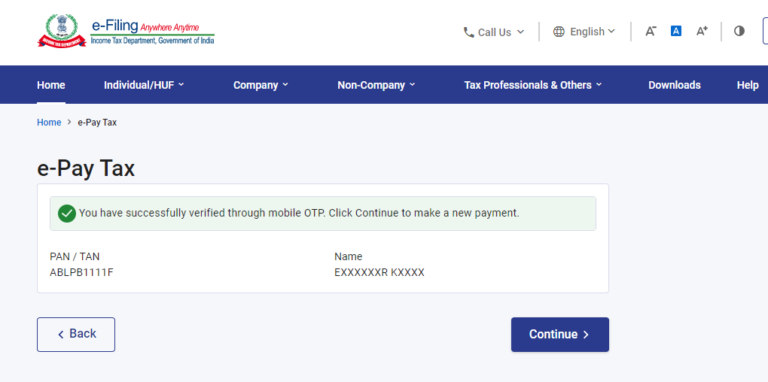

Understanding finance helps people to deal with every situation in their life because finance is a must in day-to-day life. Even if you are a student or pursuing any type of course, financial background should be there!!

Money Management is an essential part for everyone

People with finance education are better equipped to set and achieve financial goals. They can actually enjoy their life and plan for major expenses.

Protection from Scams

Financial Education is very much important for preventing people from scams related to finance. Understanding finance helps individuals recognise financial scams and control their choices. Financial Education must be taught in schools as it will help the students becoming better consumers, efficient employees, and financially prepared for the retirement.

The sooner kids understand, it’s better to make the future bright, because financial management is a way we can save for our future generations, otherwise it would be very difficult for the future generation to even live peacefully on earth. Start saving money from now, invest it in a proper way!!!

The correct understanding of money management will help us in making better financial decisions in our day-to-day life without much hassles.