- Introduction

- Last Date to link PAN with AADHAR

- People Exempted from the PAN Linking Deadline

- Consequences of not linking PAN with AADHAR

- Late Fee/Penalty for Linking PAN

- How to check if PAN is linked with AADHAR?

- Pre-requisites for linking PAN

- How to link PAN with AADHAR online?

- Solution to mismatch in the Name/Gender/Date of Birth

- Linking PAN through Biometric-based Authentication

- What to do if AADHAR is linked to the wrong PAN?

- PAN linking status

- Conclusion

- FAQ's

Introduction

The Income Tax Department under the Ministry of Finance in 2020, made it mandatory to link PAN with AADHAR for all taxpayers in the country. Since then the IT Department and the Government of India is asking people to link their PAN card with their AADHAR card. But till date, millions of PAN cards are still not linked with the AADHAR. The government of India has declared June 30th, 2023 as the last date to link PAN with AADHAR with a late fee of 1000/ rupees. Earlier, the IT department set 31st March 2023 as the last date for linking PAN which was then extended to June 30th. If a taxpayer will not link his PAN within this deadline, then their PAN Card will become inoperative.

Here we have provided a complete guide to check if your PAN is linked with your AADHAR and How to link them online or offline.

Last Date to link PAN with AADHAR

The last Date to link PAN with AADHAR was 31st March 2023 with a penalty of 500/ rupees and later extended to 30th June, 2023 with a penalty of 1,000/- rupees. From July 1st, 2023 the PAN Card will become inoperative.

People Exempted from the PAN Linking Deadline

- People above the age of 80.

- Individuals residing in Jammu Kashmir, Meghalaya, and Assam.

- Non-resident Indians (NRI)

- Not a citizen of India

Consequences of not linking PAN with AADHAR

After the end of the deadline for PAN-AADHAR Linking, the respective PAN Card will become inoperative and the PAN Holder will face the following consequences:

- PAN cards will become inoperative automatically and PAN holders will not get a refund of any amount of Tax due under the IT act of India.

- Tax Deducted at Source (TDS) will be deducted at a higher rate.

- Tax Collected at Source (TCS) will be collected at a higher rate.

- One may not be able to file the Income Tax Returns (ITR) and the due returns will not be received.

- Depositing Transactions of more than 50,000/ rupees will not be carried out due to the inoperative PAN card.

- Demat, Trading, and Banking Accounts associated with the PAN may face problems.

The PAN Card will become inoperative from July 1st, 2023 and all these issues will arise and remain till the PAN card is made operative by paying a fee of 1,000/ rupees.

Late Fee/Penalty for Linking PAN

The income Tax department made it mandatory to link the PAN cards by 31st March 2022 and then extended the dates to 30th June 2022. Taxpayers who have linked their PAN Card between 1st July 2022 to 31st March 2023 paid a penalty of 500/ rupees. And the dates were again extended from 31st March, 2023 to 30th June 2023 with an increased penalty of 1,000/ rupees.

So, if the PAN is not linked with AADHAR by March 31st, 2023 then it can be linked only by paying a late fee/penalty challan of 1,000/ rupees till June 30th, 2023.

How to check if PAN is linked with AADHAR?

To link the PAN with AADHAR, one has to visit the official site of the Income Tax Department of India.

- Visit the Official Site of Income Tax.

- Click on ‘Link AADHAR Status‘.

- Enter your PAN & AADHAR number.

- View Link AADHAR Status

After entering your PAN & AADHAR number you will get a pop mentioning the status of your PAN-AADHAR linking. If it says ‘Your PAN XXXXXXXXXX is already linked to given AADHAR XXXX XXXX XXXX’, then your AADHAR is already linked & you don’t have to worry. But if the status is ‘Your PAN is not linked to the AADHAR’ then follow the steps explained later in the article to link the PAN & AADHAR.

Pre-requisites for linking PAN

- You should have a valid PAN and AADHAR Card.

- Your Name in AADHAR and PAN Card should be the same except for the minor differences.

- Your Gender and Date of Birth should be the same in both AADHAR & PAN.

- You should have a valid mobile that’s linked with your AADHAR Card. The user will receive the OTP on this number.

How to link PAN with AADHAR online?

To link the AADHAR with the PAN, visit the official site of Income Tax (e-filling). Follow the steps given below to link PAN with AADHAR:

- Visit the website of the Income Tax e-portal

- Click on ‘Link AADHAR‘ and enter your PAN & AADHAR Number.

- Click on ‘Continue to Pay through e-pay Tax

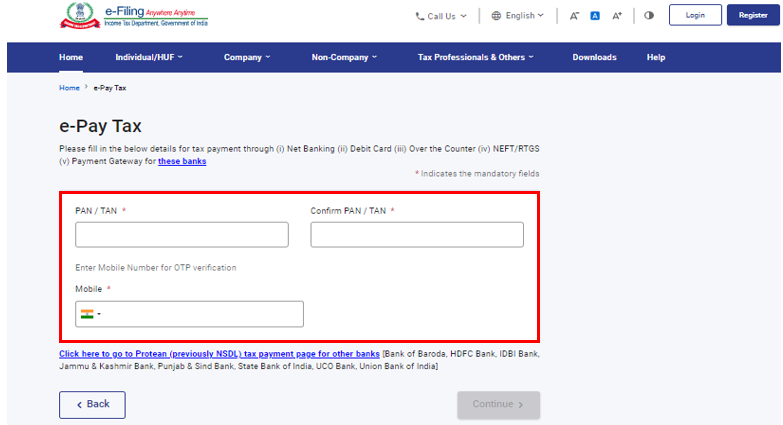

- Enter your PAN, Confirm PAN, and any Mobile number to receive OTP

- After OTP verification, you will be redirected to e-Pay Tax page.

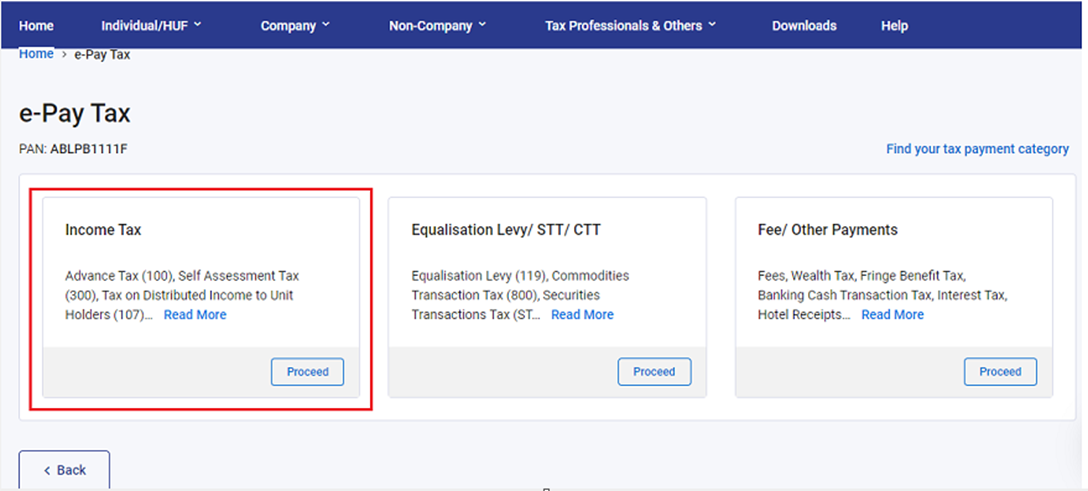

- Click on ‘Proceed on the Income Tax Tile’.

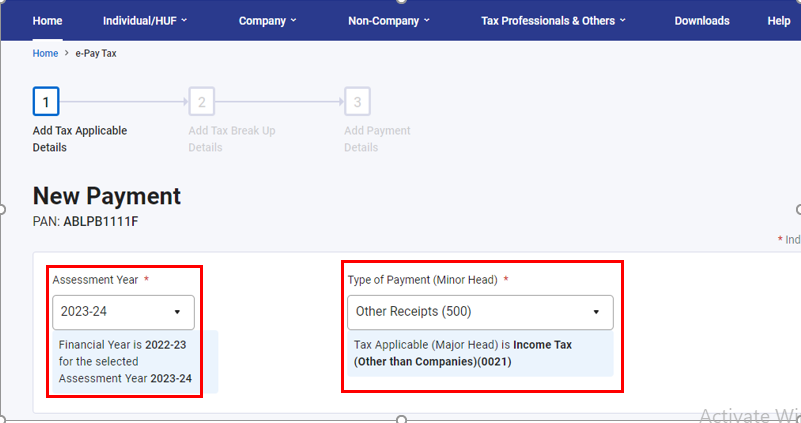

- Select AY (2023-24) and Type of Payment as Other Receipts (500) and Continue.

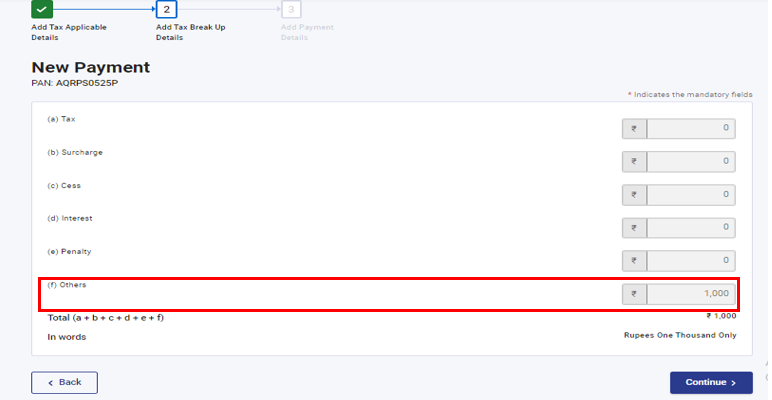

- The applicable amount will be pre-filled against Others and click Continue.

- Now, a challan will be generated. On the next screen, you have to select the mode of payment after selecting the mode of payment you will be redirected to the Bank website where you can make the payment. It may take a couple of minutes to reflect the challan.

- After making the payment & generating the challan, revisit the ‘Link AADHAR’ tab on the e-portal website.

- Enter your PAN & AADHAR Number and click ‘Validate’.

- After validating PAN and Aadhaar you will see a pop-up message that” Your payment details are verified”. Please Click Continue on the pop-up message to submit Aadhaar PAN linking request.

- Enter the mandatory details as required and click on Link Aadhaar.

- Enter the 6-digit OTP received on mobile no. mentioned in the previous step and click on Validate.

- Your request for linking of Aadhaar will be submitted successfully, now you can check the Aadhaar-PAN link status after 48 hours.

Solution to mismatch in the Name/Gender/Date of Birth

If you have a mismatch in the Name, Gender, or date of Birth mentioned in the PAN & AADHAR Card. Then firstly you have to check the correct details and match with the details present in AADHAR & PAN. you can rectify the mistake in AADHAR, PAN or both through their official sites.

Rectify details in PAN

Name, Gender or Date of Birth can be corrected in PAN online through Protean or UTIITSL by paying a small amount of fee. Users can either download the E-PAN or apply for the physical delivery of PAN Card.

Rectify details in AADHAR

Basic Demographic Details can be corrected in AADHAR online through the official website of UIDAI. Other details like Name can be corrected by visiting a nearby AADHAR Enrollment Centre.

Note: The update in the PAN & AADHAR Card may take a few days to be executed. In case you don’t have this much time to update the details then you can opt for the Biometric-based Authentication explained below.

Linking PAN through Biometric-based Authentication

Even after paying the 1,000/ rupee challan, some people are unable to link their AADHAR with PAN due to the mismatch in the Name/Gender/DOB in AADHAR & PAN Card. To facilitate smooth linking of PAN & AADHAR, in case of demographic mismatch, the Income Tax Department has recently came up with a Biometric-based Authentication where a user can link his PAN & AADHAR by visiting a dedicated center of PAN Service Providers (Protean & UTIITSL).

Process to link PAN through Biometric-based Authentication

- Search & Visit your nearby dedicated center of PAN Service Providers (Protean & UTIITSL).

- Carry Your PAN & AADHAR Card.

- Carry the receipt of 1,000/ rupees challan (if paid).

- Ask the person at PAN Center to link your AADHAR with PAN.

- Show the tweet by Income Tax India embedded below if they are unaware about it.

What to do if AADHAR is linked to the wrong PAN?

If your AADHAR is linked with a wrong PAN number then in this case you will have to submit a request to your JAO (Jurisdictional Assessing Officer) for delinking Aadhaar from PAN. After delinking, submit Link AADHAR request after fee payment of applicable amount, if not already done.

To know your JAO’s contact details visit

https://eportal.incometax.gov.in/iec/foservices/#/pre-login/knowYourAO (Pre login)

or

Login to e-Filing portal>> Go to My Profile >> Click on Jurisdictional details(Post login)

PAN linking status

On successful Validation, a message will be displayed regarding your Link Aadhaar Status.

If the Aadhaar-Pan link is in progress:

If the PAN Linking is successful:

Conclusion

So, now it must be clear to you that how to link PAN & AADHAR easily. If you don’t have any demographic mismatch in your records then you can opt for Online method else opt for Offline Biometric-based linking.

FAQ’s

Every individual who has been allotted a permanent account number (PAN) as on the 1st day of July, 2017, and who is eligible to obtain an Aadhaar number, shall intimate his Aadhaar number in the prescribed form and manner. In other words, such persons have to mandatorily link their Aadhaar and PAN before the prescribed date (Presently, 31.03.2022 without fee payment and 30.06.2023 with prescribed fee payment).

>You should have a valid PAN and AADHAR Card.

>Your Name in AADHAR and PAN Card should be same except the minor differences.

>Your Gender and Date of Birth should be same in both AADHAR & PAN.

>You should have a valid mobile that’s linked with your AADHAR Card. The user will receive the OTP on this number.

>People above the age of 80.

>Individuals residing in Jammu Kashmir, Meghalaya and Assam.

>Non-resident Indians (NRI)

>Not a citizen of India

The prescribed fee of Rs 1000/- from 1st July,2022 should be paid in a single challan will be applicable before submission of Aadhaar-PAN linkage request on e-filing portal.

No, one should only make a single payment under minor code 500.

In this case, you can wait for an hour & retry to link again.

There is no provision of refund of such payment.

No, Same Challan can be considered to link the AADHAR-PAN.

After the end of the deadline of PAN-AADHAR Linking, the respective PAN Card will become inoperative and the PAN Holder will face following consequences:

>PAN Card will become inoperative automatically and PAN holder will not get a refund of any amount of Tax due under the IT act of India.

>Tax Deducted at Source (TDS) will be deducted at a higher rate.

>Tax Collected at Source (TCS) will be collected at a higher rate.

>One may not be able to file the Income Tax Returns (ITR) and the due returns will not be received.

>Depositing Transactions of more than 50,000/ rupees will not be carried out due to the inoperative PAN card.

>The Demat, Trading and Banking Accounts associated with the PAN may face problems.

The PAN Card will become inoperative from July 1st, 2023 and all these issues will arise and remain till the PAN card is made operative by paying a fee of 1,000/ rupees.

You can update your AADHAR details at https://myaadhaar.uidai.gov.in/ & PAN details at https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

In case, you’re not able to update the correct data in PAN or AADHAR then you can also opt for Biometric-based Linking at dedicated PAN Service Centers (Protean & UTIISL).

You will have to link your PAN with AADHAR post the payment of 1,000/ rupees at e-pay tax.

If your AADHAR is linked with a wrong PAN number then in this case you will have to submit a request to your JAO (Jurisdictional Assessing Officer) for delinking Aadhaar from PAN. After delinking, submit Link AADHAR request after fee payment of applicable amount, if not already done.

To know your JAO’s contact details visit

https://eportal.incometax.gov.in/iec/foservices/#/pre-login/knowYourAO (Pre login)

or

Login to e-Filing portal>> Go to My Profile >> Click on Jurisdictional details(Post login)

Yes, linking of AADHAR with PAN is also mandatory for minors.

No, Aadhaar-PAN linking is not mandatory for filing of Income Tax Return but such person can face various issues due to inoperative PAN.