Pursuing higher education can be a life changing endeavour. Higher education is a powerful key to open a door to higher opportunities and a great future! However the cost of education, college fees, tuition, books, living expenses can be a great burden, it can be financially challenging to many families which can give a very wrong impact to students.

To cover this financial gap, taking a loan for education can be a big relief. Education loans can actually be compared with a water body which has millions of water droplets. Here droplets refer to challenges while taking loan. It is very important to clear all the concepts and ensure a smooth journey ahead. Some of the guidelines a person who is taking loan should keep in mind –

Analyse your personal financial status

Before thinking of opting for an education loan, first calculate your own financial status, how much savings you have or how much money you can spend on the loan. Understanding or analysing your condition will surely help in thinking which loan.

Determine your end goal

Before taking an educational loan, it is essential to have a clear mindset of your educational goal. Consider the type of degree you are going to pursue and what will be the expected loan you will need.

Prepare an emergency list

As it is said, Life is unpredictable and emergencies may arise any time. Before applying for an educational loan, keep an emergency fund aside for you to cover the expenses.

Check the loan details properly

Consider all the instructions before taking the educational loan properly. The educational loan comes with varying interest rates and loan terms. It’s very important to understand it. Fixed or variable interest rates can significantly affect the overall cost of loan.

Choose the correct lender

You should compare loan offers from different lenders to find the best terms that suits your financial condition. Look for a lender who can be little flexible in terms of payment to you. Before searching for the appropriate lender, consider if the lender is reputed or not and if the customer service is good or not. To have a quality life or stress free life after loan, you must opt for the correct lender.

Borrow Responsibly

It’s tempting to borrow the maximum loan amount available, but it’s crucial to borrow only what you need. Remember that you will have to repay the loan with interest, and excessive borrowing can lead to financial strain in the future.

At the end, education loans can be valuable tools to finance your higher education dreams, but they come with responsibilities and potential long-term financial implications. Before applying for an education loan, carefully consider your educational goals, financial situation, loan options, and repayment strategies. By making informed decisions and borrowing responsibly, you can pursue your education while minimizing financial stress and achieving your academic and career aspirations.

Should you consider taking an Education Loan for your College Studies?

Title

NCHM JEE Exam 2024 | Application Closing Soon!

The National Council of Hotel Management (NCHM) Joint Entrance Examination (JEE) serves as a vital…

Rat Race to clear the UPSC Civil Service Examinations

The UPSC Civil Service Examination stands as one of India’s most fiercely competitive tests, administered…

Exploring the Top Paramedical Courses…

Imagine the canvas of healthcare as a masterpiece in progress, and paramedical courses as the…

NIMCET 2024 Applications Open: Apply for MCA Admission in NITs

NIMCET (National Institute of Technology MCA Common Entrance Test) is a National-level entrance exam conducted…

Sleep Hygiene: Tips to Enhance Your Sleep Quality

Enhancing the quality of our sleep is pivotal for maintaining optimal physical and mental well-being….

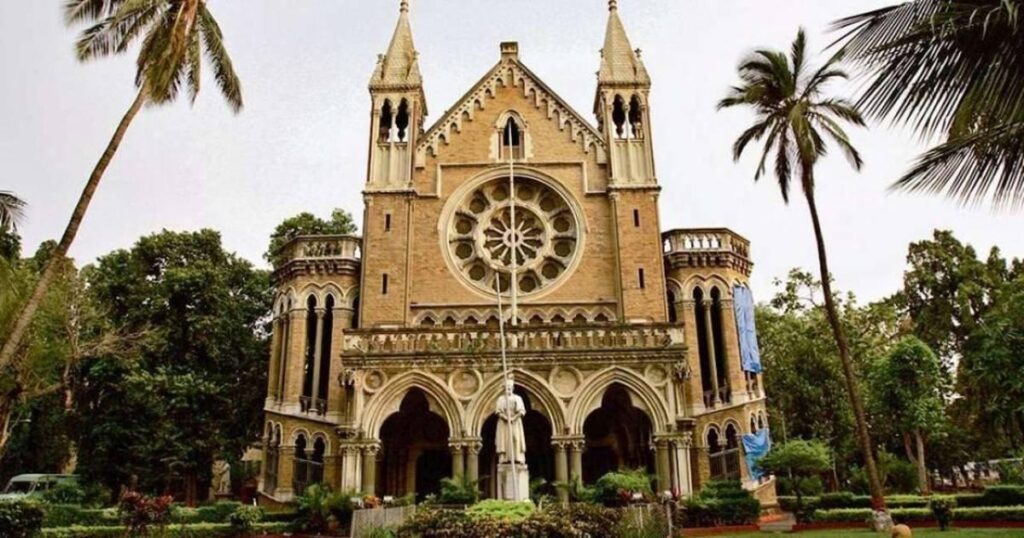

Exploring the Timeless Legacies: India’s Oldest and Heritage Universities

Step into the corridors of academia in India, and you’ll encounter the hallowed grounds of…

Bhashini: India’s own AI-Powered Language Translation Tool

Unveiled by Prime Minister Narendra Modi, Bhashini emerged as a groundbreaking AI-powered language translation tool…

Understanding PharmD, B.Pharm, and D.Pharm: Unravelling the Differences, Scope, and Opportunities

In the domain of pharmaceutical education, several programs cater to aspiring pharmacists, each offering distinct…

UPSC CSE 2024 Notification Released! Read details

To all the Aspiring civil servants, rejoice! The Union Public Service Commission (UPSC) has officially…

8 Programming Languages worth learning in the year 2024

Programming languages are formal systems designed to instruct computers to perform specific tasks. They provide…

B.A.M.S. – A Holistic Career Choice in 2024

In the vast landscape of career opportunities, the Bachelor of Ayurvedic Medicine and Surgery (B.A.M.S.)…

Interim Budget 2024 – Key Highlights!

Introduction Today on February 1st 2024, Finance Minister Nirmala Sitaraman is presenting the last budget…